Insiders sell to buy ratio was favorable during the week compared to the previous week. I would like to understand why there are so many ups and downs in the insider activity week over week. Nothing has fundamentally changed in quite some time although the investor confidence seems to be in good shape if the volatility index (vix) is any indication. Following table shows the sell to buy ratios for past three weeks.

Top buys and sells during the week are shown in the table below. Some of the names like BIF have become a permanent fixture in the top buys section of the table, at least in past 2-3 weeks. Some thing is definitely up there although there is only a single insider who is doing all the purchasing.

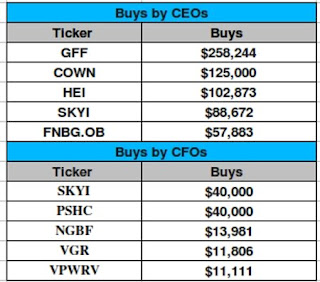

Top buys by C-Level officers of the company are shown in the table below. I have been noticing that not too many CFOs putting in their neck forward. Should we be cautious like them or just that CFOs are relatively poor bunch?

Finally the industrial trends are shown in the table below. This is third consecutive week when independent oil has made it to this list.

I wish you all a very happy new year. Like rest of the market I hope that we actually recover at the pace that is priced into the market. Good luck to all.