What a difference one week can make. Last week it was quite evident that bulls are taking back the charge and market is at it highest level for the current year. Employment numbers, how so ever skewed they may be, did give market a positive momentum. Positive energy is good after all it is the perception that matters especially in the times of gloom.

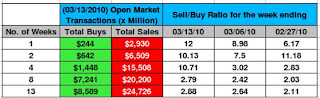

The top transactions for the week are shown in the table below.

The rolling averages for past several weeks are shown in the table below. The insiders are selling again. Not sure what does that mean especially when they were on a buying binge for past 8-10 weeks. It is still not bad number so as to alarm the investors. Nonetheless, it needs to be watched closely, because 3 months back when this happened, market started to languish a bit after that.

Industrial trend is showing an insignificant number of insider buys from any particular industry. Reason being the insiders are cashing out anyways so no surprises there. I hope this trend does not take a turn for worst in next few months.

Since there is so much positive perception out there in the market, a word of caution, when every thing seems so rosy and every one thinks that market has only one way to go, that is when the surprises show up. So best of luck to all with that note of caution because it does not matter how much paper profits you have, what matters is how much money you have in the bank.